Blog by Jonathon Cocks

In my previous blog I asked the question “When in the economic cycle is the best time to invest in Venture Capital?”, with past data suggesting that VC funds outperform public markets when funds launch just as public markets are coming off their peaks.

In this blog I’ll turn my attention to what kinds of VC funds outperform.

There are many ways that VC funds differentiate themselves, such as the size/stage of their investee companies or the geographies they invest in. But given that Velocity Ventures’ main differentiator is that we are a specialist fund focussed exclusively on Travel & Hospitality startups I thought a key question to ask ourselves next is “Do Specialist Funds outperform Generalist Funds?”.

The theory behind a specialist fund is that a specialist manager has deep sector knowledge and networks that allow them to:

a) increase access to quality deal flow,

b) select better investments,

c) mentor and assist their portfolio companies to better performance, and

d) facilitate industry exits.

In late 2023 Pitchbook released a report on this topic analysing the performance of 1,306 VC funds with vintages between 2000 and 2020, which allows us to use past data to test whether this theory has held true. The data was also broken down by “fund size” allowing us to look only at the data for funds under $250m of AUM, which is the space that Velocity Ventures, as an early stage investor, operates.

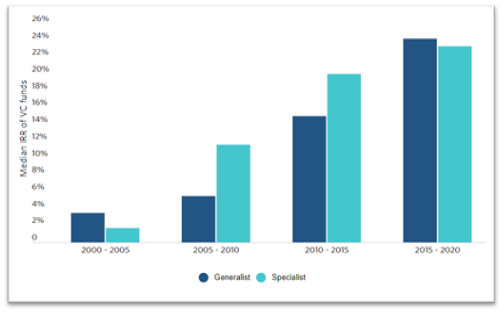

For VC funds under $250m, specialist funds tend to outperform generalist funds in terms of both Total Value to Paid-In (TVPI) and Internal Rate of Return (IRR). Given differences in fund lives, we’ll focus only on IRR.

Source: PitchBook “Battle of the funds: Do VC specialists outperform generalists?”

Data from the pitchbook study shows that specialist funds outperformed generalist funds with an average IRR of 15% across the 20-year period versus only 11% for generalist funds, with the specialists outperforming the generalists in 3 out of the 4 periods studied.

Good Managers or Good Sectors?

Although the above data supports the theory that specialists outperform generalists, this is not the end of the story. Do they outperform because they are more skilled in picking investments? Or is it because the sectors they happen to invest in outperformed the broader market?

To test this, another report by Pitchbook examined a sample of 451 US-based VC funds with vintage years between 1996 and 2015. In this study the results of the specialist funds were benchmarked to the performance of the sectors they invested in. So rather than comparing “do specialists outperform generalists?” they asked the question “do specialists outperform public markets indices for their sector by more or less than generalists outperform general market indices?”.

The investigation found that while specialists do outperform market indices for their sector and generalists also outperform broader markets indices, the margins of outperformance were rather similar between the 2 groups. Therefore, it appears that specialist managers beat generalists not because they’re better at choosing investments, but because they’re better at choosing sectors.

One conclusion is that specialists in underperforming sectors often refrain from launching funds, anticipating poor performance, whereas generalists continue to invest in these underperforming sectors, thus negatively impacting their overall performance.

Specialist Firms or Specialist Partners?

A third report by Paul Gompers, Anna Kovner and Josh Lerner takes this research even deeper by analysing over 24,000 VC investments made by over 800 VC firms between 1976 to 2003. This research not only measured the level of specialisation of the VC firm, but also of the individual partners within the firm.

The data showed, again, that increased specialization of a VC firm was associated with greater success. It also showed that generalist firms performed better when they had more specialist partners in their team. Interestingly though, it showed that specialist firms are not better off by having overly-specialist teams, and that the best results came from specialist firms with a broader mix of specialists and generalists in the team.

Summary

- All 3 studies reached the same conclusion – specialists outperform generalists.

- The outperformance is partly because specialists pick good sectors (rather than just good investments).

- Specialist funds do even better when they have a mix of specialist and non-specialist partners, rather than only specialist partners on the team.